Materiality is crucial for sustainability reporting because it allows companies to focus on the most important aspects of their sustainability efforts.

A company can choose to report on all aspects of its sustainability program, but this would be extremely time-consuming and would probably not be very useful for investors and other stakeholders who want to know about how a company is handling both its impacts on the environment and society, and how it is impacted by broader ESG issues.

What is Materiality: definition

Materiality refers to identifying the issues that matter most to a company’s business and stakeholders and determining how important they are.

By focusing on material issues, companies can make sure they are reporting on the most important and significant issues so that their reports are useful and informative.

Definitions of materiality vary among ESG frameworks.

Principles and concepts

Objectives behind the concept of impact

At the moment, there are three separate common approaches to materiality:

- financial materiality

- double materiality

- dynamic materiality

Different regions and organizations may favor one approach over the others, although preferences will likely shift and evolve as sustainability reporting advances (see table at the end of this section).

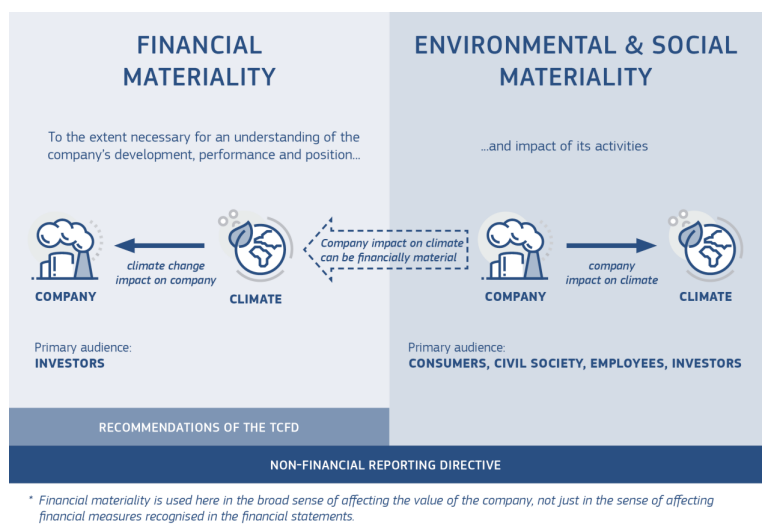

Financial Materiality

- Financial Materiality seeks to identify information that is likely to impact a company’s operating condition and financial performance.

Financial materiality centers investors, and comprises one major perspective on materiality: shareholder-oriented and focused on the external issues that are likely to affect the organization’s financial value.

For instance, a financial materiality approach might consider the issue of corruption material if fines were levied on the company.

The financial materiality approach is common among US and UK regulations and organizations.

Double Materiality

- Double Materiality is a combination of financial materiality and impact-based materiality.

Impact-based materiality determines materiality by assessing whether a company’s activities might have a significant impact on the economy, environment and people.

For instance, an impact-based materiality approach might consider climate change a material issue for a company that is carbon-intensive, because that company is negatively impacting the environment.

This emphasis on external impacts and a broad set of stakeholders differs from the definition of materiality typically used to guide financial reporting, which is focused on financial impacts of interest to investors.

Given that double materiality incorporates both the financial perspective and the impact-based perspective, the double materiality approach encourages corporations to consider both the impact of a sustainability issue on the company’s value and on stakeholders (economy, environment and people).

The concept of double materiality was first proposed by the European Commission in 2019, and is more commonly adopted in European Union countries.

The Non-Financial Reporting Directive (NFRD) and the European Financial Reporting Group (EFRAG) both acknowledge double materiality as key sustainability reporting standard-setting.

Source: European Commission, “Guidelines on reporting climate-related information”, 2019.

Dynamic Materiality

- Dynamic Materiality proposes that issues that were not previously considered may become material over time, and that there are certain triggers for this process.

Dynamic materiality is the most recent iteration of materiality, and was first introduced in early 2020 by the World Economic Forum (WEF).

Dynamic materiality takes the perspective that materiality is a process that unfolds over time, rather than a firm designation.

The theory behind dynamic materiality is that businesses in the early stages of growth may negatively impact society because they lack the resources or experience to identify and fully address some issues as material.

However, changing norms such as stakeholder activism, regulations, and/or corporate innovation may eventually motivate the company to adjust their materiality assessment and take action on the issues that they had previously overlooked.

Thus, from the dynamic materiality perspective, materiality evaluations are not static. Rather, materiality assessments present an opportunity for strategic foresight and consideration of external driving forces that may impact the company’s way forward.

Summary table of the positions of renowned ESG frameworks (voluntary or regulatory reporting) on materiality

| Financial Materiality | Double Materiality | Dynamic Materiality |

|---|---|---|

| Sustainability Accounting Standards Board (SASB) | Global Reporting Initiative (GRI) | Carbon Disclosure Project (CDP) |

| MSCI Rating System | European Financial Reporting Advisory Group (EFRAG) | Climate Disclosure Standards Board (CDSB) |

| International Sustainability Standards Board (ISSB) | Sustainable Development Goal (SDG) Disclosure Recommendations | International Integrated Reporting Council (IIRC) |

| US Securities and Exchange Commission (SEC) | Corporate Sustainability Reporting Directive (CSRD) / Non-Financial Reporting Directive (NFRD) | |

| Task Force on Climate-related Financial Disclosures (TCFD) | Sustainable Finance Disclosure Regulation (SFDR) |

Implications for companies

Materiality assessments are the process by which companies identify and seek to understand the issues that are most important to their practice, given their unique operating concepts.

Materiality analyses are beneficial to corporations in that such analyses can help provide insight into future trends, contribute to the company’s overall risk assessment, and monitor the topics that are important to stakeholders. Materiality assessments also contribute to transparency and accountability in a company’s processes, and therefore, indirectly contributes to stakeholder satisfaction.

Furthermore, not completing a materiality assessment presents financial, reputational, and legal risks. Forgoing a materiality assessment could mean missing key issues, failing to address stakeholders’ concerns, and/or failing to build resilience for future events.

Thus, there is currently a growing demand for materiality analysis, as investors and even governments increasingly see this process as part of a necessary due diligence effort.

A materiality analysis is usually illustrated by a materiality matrix, as shown in the example below.

Source: Unilever

Practical approaches and implementation of materiality assessments

The steps for a materiality assessment may vary depending on the process that the company in question wants to take.

However, the steps below provide an idea of what the process generally looks like.

Identify stakeholders

Gather insights from both:

- Internal stakeholders (eg. Board members, employees, executive leadership, managers, etc).

- External stakeholders (eg. Customers, investors, peer companies, local communities, etc.)

Conduct initial stakeholder outreach

Develop a communication strategy and utilize contextually appropriate outreach channels, either qualitative (interviews with stakeholders) or quantitative (surveys and other hard data collection) – both are necessary to gain a holistic understanding of stakeholder values and expectations.

Design and launch materiality survey

- Identify topics that the company will use to assess/determine priority issues. Material topics are often categorized according to ESG parameters (eg. Environmental, Social, Governance issues), sometimes with the addition of economic indicators.

- Launch and disseminate the survey to relevant audiences

Analyze insights from the survey

Rate the results based upon the predefined scoring methodology. Review both quantitative and qualitative aspects.

The key end result should be a formal matrix graph that plots how each issue ranks in significance relative to stakeholder expectation.

Such graphs, called materiality matrices, are useful in visualizing and mapping out the universe of issues that the company is considering.

Gain necessary approval and support

- Ensure that the materiality analysis results in a clear roadmap (i.e. targets and policies on the most material issues) that is aligned with overall corporate strategy/mission

- Make sure relevant internal and external stakeholders are involved in this roadmap

- Put proper oversight processes into place for accountability purposes

Publicize the results and/or take action

Share the results from the materiality assessment. This is usually done through a formal CSR report, and is later disseminated through channels such as the official company website or other media.

To conclude...

Materiality assessments are crucial to help companies prioritize what needs to be addressed first, so they can focus on the most important aspects of their sustainability efforts, instead of getting distracted.

So, what are you waiting for?

If you want to succeed in your sustainable journey… Save time and begin the process today with apiday!

We’ll support you through your materiality assessment and identify where your energy should be dedicated, with a step-by-step roadmap.

Get your organization started and book a call with our ESG experts!

Related articles

Global Reporting Initiative: What It Is and How to Do It

GRI stands for Global Reporting Initiative, and is an international independent standards organization that promotes sustainability reporting through the development of global standards for corporate responsibility, including environmental, social and governance (ESG) reporting...

Impact – What is Impact

The Corporate Sustainability Reporting Directive (CSRD) requires large businesses and SMEs to produce annual reports on their environmental and social impacts.

CSRD – What is CSRD

The Corporate Sustainability Reporting Directive (CSRD) requires large businesses and SMEs to produce annual reports on their environmental and social impacts.

Corporate Sustainability Reporting Directive: All you need to know

The Corporate Sustainability Reporting Directive is an EU regulation that will have a huge impact on how organisations report their environmental, social and governance (ESG) performance...

Sustainability – What is Sustainability

The GRI is an international independent standards organization and currently issues one of the most well-known standards for ESG reporting (GRI Standards).

Discover the latest Sustainability Recent Developments to improve your companies

Sustainability is a concept that evolves due to pressing sustainability challenges, worldwide issues, and its own concept limits. New concepts have emerged to think further and respond better to all the world’s current challenges...

GRI – What is the Global Reporting Initiative

The GRI is an international independent standards organization and currently issues one of the most well-known standards for ESG reporting (GRI Standards).

Materiality – What is Materiality

ESG is an acronym for Environmental, Social, and (Corporate) Governance. It refers to the non-financial factors of a corporation’s impact.

EcoVadis – What is EcoVadis rating

Created in 2007, EcoVadis provides a collaborative web-based rating platform for assessing the sustainability performance of organizations worldwide.

Impact-washing – What is Impact-washing

Impact washing can be defined as any marketing claim about a product/good/service/funds triggering a change in the real economy that cannot be supported by evidence.

ISO 26000 – What is ISO 26000

ESG is an acronym for Environmental, Social, and (Corporate) Governance. It refers to the non-financial factors of a corporation’s impact.

B Corp – What is B Corporation certification

ESG is an acronym for Environmental, Social, and (Corporate) Governance. It refers to the non-financial factors of a corporation’s impact.

The concept of impact on social and environmental issues and its implication for companies

Impact measurement is a powerful tool for companies to gauge their impact on social and environmental issues. In this article, we will discuss the concept of impact, its implications for organizations, and how it can be measured...

The most important and recent developments of ESG (Environmental, Social and Governance)

Being a B Corporation is not just about making profits and creating wealth for a company, it is a way of creating a more sustainable future for society! Discover our article about B corps and its benefits here...

The process for an enterprise to get the B corp certification

Becoming a B Corporation is an ambitious undertaking. This article will guide you through the steps required to become a B Corporation…

CSR – What is Corporate Social Responsibility

CSR is centered on the idea that businesses have a responsibility to benefit the society that they exist within—a broader view than the one that says businesses’ only responsibility is to produce economic profit.

What is a B Corporation: what this means and its benefits for companies

Being a B Corporation is not just about making profits and creating wealth for a company, it is a way of creating a more sustainable future for society! Discover our article about B corps and its benefits here...

The guide to EcoVadis certification: frequently asked questions

This guide will take you through the steps of the EcoVadis Certification process, and explain what is involved in becoming a certified business...

The implications of ISO 26000 for companies

ISO 26000 is a standard providing direction for the application of social responsibility to the activities of an organization. But what does this mean? And how can organizations use it to create better and more sustainable business practices? Let's talk about it…

What is the meaning of CSR (Corporate social responsibility) and how to adopt it?

A Corporate Social Responsibility strategy refers to an organization's active consideration of the effects its activities have on the environment, employees, customers, and suppliers. Let's look at how your company could adopt such a program...

ESG – What is Environmental, Social and Governance

ESG is an acronym for Environmental, Social, and (Corporate) Governance. It refers to the non-financial factors of a corporation’s impact.

4 reasons companies should adopt CSR, Corporate social responsibility

CSR is all about managing a company’s externalities while creating sustainable value for stakeholders and continuous innovation for the business. Let's break that down and explore why...

Carbon disclosure project reporting: what is it and how does it work?

Read our article about The Carbon Disclosure Project (CDP), an extra-financial questionnaire that collects data on companies’ environmental practices and performance...

What are the differences between Corporate Social Responsibility (CSR) and Environmental Social Governance (ESG)?

These terms are both used to describe an approach for businesses to integrate social and environmental factors into their governance policies, strategies, processes, and programs. Yet, they're not the same. Let's explore their key differences...

Why is ESG (Environmental, Social and Governance) important for a business

ESG (environmental, social and governance) can help businesses make sound decisions, and investors achieve better long-term returns. Let's discover how...